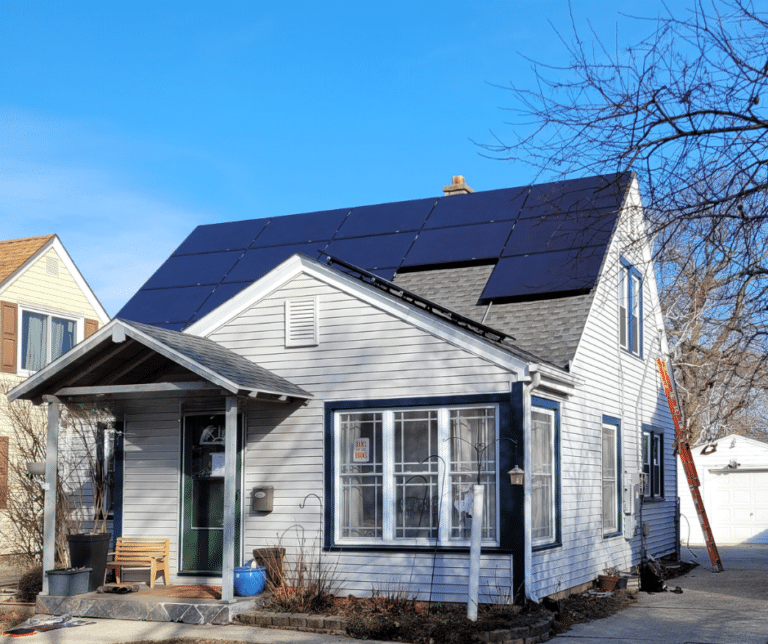

Many business owners in New Hampshire have recently been subjected to volatile energy price fluctuations and are now considering making the switch to solar energy. If you’re one of those considering solar, here are a few things you should know.

Rock solid programs

The Granite State has several rock solid, pro-solar programs in place that make switching to clean renewable energy rather appealing.

The Commercial & Industrial (C&I) Solar Incentive Program

The C&I program offers financial incentives of up to 25 percent of the total solar project cost or $10,000, whichever is less. The program is only available to commercial structures in New Hampshire with electric meters.

USDA REAP grant

The current program offers financial incentives of up to 40 percent on the total installation cost of a system, up to $1,000,000. To qualify, participants must have a qualifying commercial solar system in a rural community or serve as an agricultural producer in New Hampshire with metered connection to the power grid.

Tax exemption

Solar photovoltaic systems installed in New Hampshire are exempt from both sales tax on the purchase price of their system as well as property tax on the increased value to their property as a result of the improvement.

Net metering

Net metering is a billing mechanism that provides solar photovoltaic system owners a credit for energy they add back to the grid. Businesses in New Hampshire that generate excess energy back to the power grid are awarded a net metering credit that can later be used to offset the cost of grid-supplied electricity during non-producing hours of the day.

Federal tax incentives are available

ITC

The owner of a qualifying solar system installed by a commercial business or organization has access to the ITC federal tax incentive program. The investment tax credit (ITC) is an upfront credit that reduces your income tax liability for a portion of the cost (starting at 30 percent) of the installation of your solar system within that tax year it’s installed. In addition, the Inflation Reduction Act (IRA), passed by congress in August of 2022, positively impacted theITC by extending the program through 2033.

To learn more about solar for business, download our ebook Solar for Business or, contact an All Energy Solar representative today.