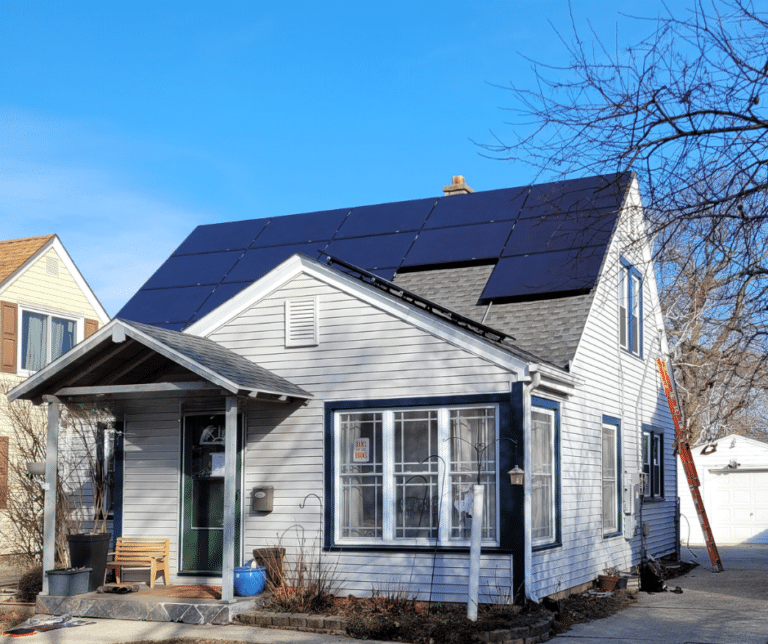

Minnesota continues its commitment to clean energy through a range of incentives to promote solar adoption among homeowners and businesses alike.

One of the primary driving forces behind Minnesota’s solar revolution is making clean, renewable solar energy more accessible and affordable for residents. These incentives not only help individuals and businesses lower their energy bills but also contribute to the state’s broader sustainability goals. Here’s a look at a range of incentives available to Minnesota residents and businesses in 2024.

Minnesota Sales Tax Exemption

New installed solar systems in Minnesota are exempt from sales tax by state law, helping to make panel installations more affordable.

Minnesota Property Tax Exemption

Minnesota has several laws that promote the use of renewable sources of electricity, including property tax exemptions for new solar installations. Unlike other home improvements that increase the value of your property, like solar, Minnesota has a statute in place that prohibits photovoltaic devices (such as solar panels) from being included in property tax assessments.

Xcel Energy Solar*Rewards Program

Xcel Energy serves roughly 1.3 million customers in Minnesota. The utility company offers Minnesota customers with solar panels the opportunity to participate in Xcel Energy’s Solar*Rewards program. Eligible customers earn $.03 for every kilowatt-hour of power their solar system generates, regardless of whether that energy is used by the system’s owner or fed back to the grid for distribution to its other customers. Qualifying participants receive an annual rebate check for a period of up to 10 years based on their previous year’s solar production. The total number of participants is limited, so submitting your application early is important.

Minneapolis Green Cost Share

Specifically for Minneapolis residents, businesses, and non-profit organizations, Minneapolis’ Green Cost Share works to reduce pollution in the city by matching funding for solar energy projects. Focused on making renewable energy more accessible for areas in the city that are disproportionately impacted by climate change, the program helps fund new solar energy projects and accepts applications for up to $50,000 in funds to help put solar on your roof.

Net metering

Net metering policies in Minnesota allow solar system owners to receive credits for excess energy produced and fed back into the grid. This means that when your solar panels produce more energy than their owner can consume on-site, the surplus can be exported back to the grid, earning the owner of the system a credit to be used at a later time.

Federal solar tax credit

In addition to Minnesota’s state programs, the federal government also offers property owners who install a solar PV system a healthy tax credit. The Investment Tax Credit (ITC) offers qualifying property owners who install solar panels a 30% tax credit on the total installation cost of their system when that system is installed between now and the end of 2032. In 2033, the federal solar tax credit will decrease to 26%. In 2034, the ITC will drop to 22%. and is set to fully expire for residential projects after 2034.

If you’re interested in learning more about the cost savings available for installing a solar system, talk with a qualified solar installer who can help guide you through the process and make you aware of any solar incentive programs you or your property may qualify for.